12 Aug Quick Start Guide

UndergroundTrader.com Quick Start Guide

This Quick Start Guide has been put together to get you up and running as quickly as possible. Let’s get rocking. We know that there are a variety of skill levels among our clients and strive to cater to everyone who makes the commitment to join our community. Members should read through the Video and Educational Library to get familiarized with the patterns and set-ups that we play. A little bit of knowledge goes a long way. Here’s a rundown of the site features.

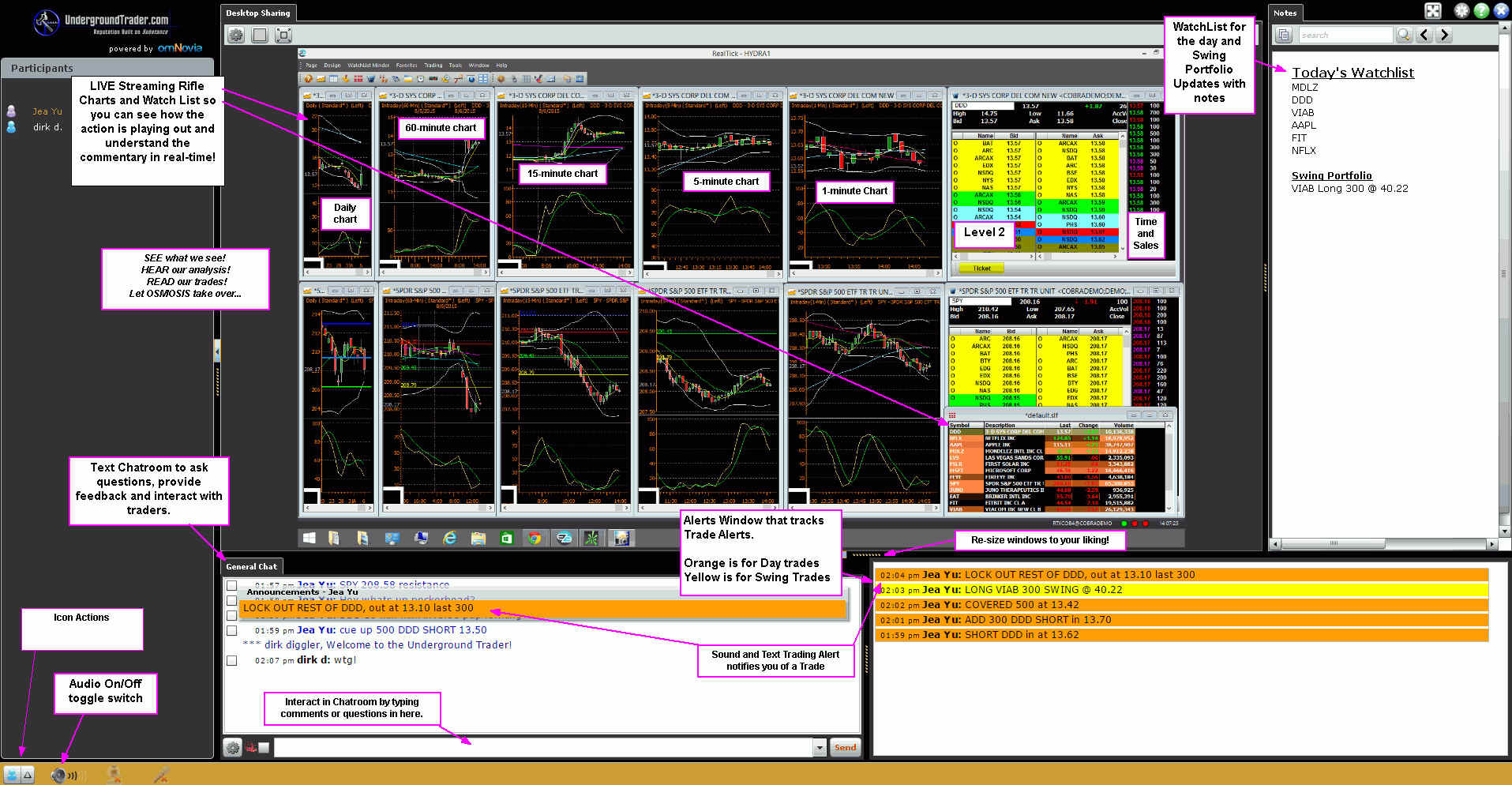

Day and Swing Trading Video Chatroom

The above graphic shows all the functions of the chatroom from the User perspective. The watch list will be available by 9am est. along with a link to the Fib charts. Please follow @JeaYu21 at Twitter to get them in click-able form.

Here is the general schedule in the chatroom:

9:00 am est. – Watch List Fib charts link posted

9:15 am est. – Watch List review

9:30-11:00 am est. - Wet Climate TradingÂ

11:00-12:00pm est. – Deadzone – Recap and Q&A of morning trades

12pm-4pm est. - Chatroom video charts feed stays open. Â We rarely trade afternoon dry climates unless there is a special event like FOMC decision.

The above schedule will apply most of the time. We are usually done by deadzone for the day with day trading, in most cases after we hit our profit target. The goal is to consistently hit our profit goals and walk with the money.

While the chatroom will stay open from 8:30-4:30 pm est., Jea may call it a day after the morning session if he feels the Dry climate will not be suitable for a group. Trust us, less is much, much more when it comes to trading. If the liquidity is not there, then we will not put our members in harm’s way.

The typical amateur trader will trade in the morning and make some profit, only to over trade in the afternoon and dig himself into a hole. We don’t let that happen. Pacing is top priority. Members are welcome to stick around and share ideas and interact during this downtime.

Chatroom Alert Format

Jea will type up a ‘CUE’ alert to inform members to prepare for a possible trade. The CUE is typed in the chatroom and is meant to bring your attention to a particular stock that may be forming a pattern. It is not meant for traders to jump in and play. It is meant to notify members that a trade may be setting up.

Depending on the time and urgency of the alert, Jea may only be able to provide the first portion of the CUE, which includes the recommended share size, the symbol and direction of trade (Long or Short). This is the format you will see in the chatroom:

Cue up 500 FEYE LONG @ 44.13 limit

Or

Cue up 500 FEYE LONG

If the stock triggers a trade, you will hear an audio bell alert and a pop up in the General chat window (bottom right window) as well as posted in the Alerts window (bottom right window) with a time stamp and color.

Long 500 FEYE @ 44.08

Or

In FEYE at 44.08

Orange refers to Day Trades, which could be held from minutes to an hour. Yellow refers to Swing Trades, which could be held hours to days or weeks.

Jea may scale into a position, which means he will an addition entry or more entries for the position get a more favorable average price. The alerts will look like this:

Added 300 FEYE Long at 44.10

Or

Added 300 more at 44.10

Once a position is taken, Jea will provide commentary in the chatroom as well as audio commentary and point out areas of interest to watch on the streaming video charts. When it’s time to exit the position, you will see an alert like this:

Sold 600 FEYE @ 44.50, 200 left

Or

Out 600 FEYE at 44.50, 200 left

Or

Sell 600 FEYE, 200 left

Which means to sell 600 shares of the 800 total share position. If he wants to LOCK OUT the position, it means to sell the rest of the position back to zero share. Like this:Â

Locked FEYE, out final 200 shares at 44.60

Or

Locked out @ 44.60

After the trade is finished, he will explain what happened and move onto another trade set-up. The goal is to trade the first 90 minutes of the market open to attain are daily profit targets. At the end of the morning session, Jea will post a summary of the trades and also the total profit or loss. He will answer any questions and de-brief the members as well as give any further guidance for the afternoon before deciding to conclude the session or return for afternoon session.

Should I play the Alerts?

First off, make sure you are familiar with the underlying stock and premise for taking the trade. The alerts are meant to be educational and demonstrate the methodology at work. Many members will play along with the alerts or adopt the alerts and play according to their temperance and comfort level.  Depending on your familiarity with the underlying stock, the methods and your account size, you can adjust to accommodate your comfort level. Make sure you brief yourself in the Video and Education Library. If you wish to get some training, please consider our private one-on-one online hourly coaching or the live on-on-one mentorship.

Video and Education Library

This section will be updated weekly with new videos, articles and chart examples. For those of you who truly seek to embrace the knowledge of our years of market experience, this will be a haven for you. Take your time and go through the videos and materials at your own pace. Repetition is key so watch in here and see the concepts played out in our live action chatroom.

Charts and Resources

This section is here to help you calibrate your charting platform to the Rifle Charts. We have pre-formatted downloadable templates or set-up instructions for most of the major direct access brokers and charting platforms. The charting platform in the video streaming chatroom is on the CobrtraTrading.com Realtick platform. We highly recommend Cobratrading.com as a trusted broker for our members and we have prepared pre-formatted charts for the platform in this section. Please visit them as our recommended broker and mention UndergroundTrader.com for specials.